The restriction on mortgage interest relief means that tax relief for interest will only be given at 20% instead of the current 40%. This will be phased in over 4 years with the 2017/18 year being the first year when landlords will notice a change to their rental profits and taxes. By 2020/21, tax relief will be at 20% on all mortgage interest payments.

For those with several properties, the loss of the ability to offset all interest expenses will lead to higher profits for tax purposes, which will push many taxpayers into the 40% tax bracket.

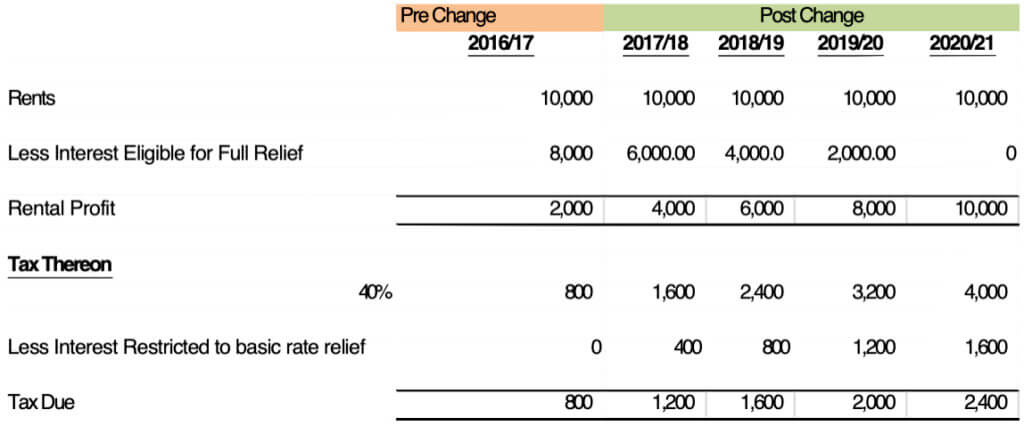

The loss of the relief is illustrated below using an example of a higher rate taxpayer who receives rental income of £10,000 and incurs interest costs of £8,000, ignoring other expenses. The profit for tax purposes rise from £2,000 in 2016/17 to £10,000 by 2020/21. The higher profit may end up being taxed at 40% depending on other income levels, whilst the relief on the interest is only at 20%.

The tax due increases from £800 in 2016/17 to £2,400 by 2020/21.

For further information contact us on 0121 783 5392 or get in touch.