What is Cloud Accounting?

Cloud Accounting has changed the way accounts are prepared as computer records can be accessed via an internet connection from any connected device, meaning they can be accessed anywhere at any time. Also, information is available in real-time and up to date, with features such as automatic bank feeds and invoice reading. Therefore, gone are the days of waiting for your crucial financial information; instead, clients have access to current data with any changes and updates being available to all users immediately.

There are many software providers in the online market. The more commonly used cloud accounting packages for SMEs include Xero, QuickBooks Online, Kashflow, FreeAgent, Clearbooks and Sage Business Accounting. All offer users many benefits including:

- Ability to access real-time data

- Improved processes and controls

- No need to back up data

- Strong cloud security

- Automatic software updates

Cloud solutions can be readily customised to tailor them per your requirements to improve efficiencies and provide the user with greater insights into their critical financial data.

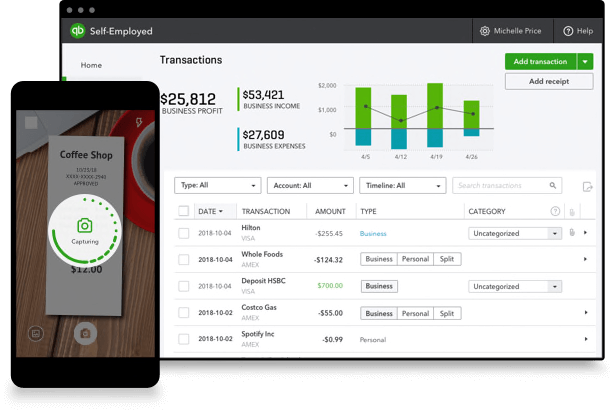

Many of the accounting packages have complimentary mobile accounting apps so users can undertake tasks while they are on the go. For example, you can approve invoices, pay bills and prepare quotes, to ensure there are no delays in providing information to customers or suppliers.

Extending your software even further.

A simple example of the additional apps available as add-ons to your accounting software is optical character recognition (OCR) software. This lets a user take a photo of a receipt via the mobile phone app and have it processed and the entry made in the accounting records with a digital image of the receipt or invoice attached to it. Not only does this save time, but it also means that the business no longer needs to keep a paper copy of the entry as the digital one will suffice. This has been confirmed and even encouraged by HMRC.

A simple example of the additional apps available as add-ons to your accounting software is optical character recognition (OCR) software. This lets a user take a photo of a receipt via the mobile phone app and have it processed and the entry made in the accounting records with a digital image of the receipt or invoice attached to it. Not only does this save time, but it also means that the business no longer needs to keep a paper copy of the entry as the digital one will suffice. This has been confirmed and even encouraged by HMRC.

Isn’t Cloud Accounting old news?

Cloud Accounting has been around for a number of years, and while many businesses have adopted the new tools, most have chosen to stick to tried and trusted methods of manual bookkeeping.

However, with the advent of Making Tax Digital (MTD), there is a renewed focus on Cloud Accounting. MTD is HMRC’s requirement for all VAT registered businesses to keep digital records and file VAT returns in a digital format. HMRC also plans to implement this across other taxes such as corporation tax and income tax, though this will be in the next couple of years.

HMRC has created a list of approved software providers for VAT return submissions under MTD, and this list is being added to as more providers develop software to meet their requirements. The list of approved suppliers includes Xero, QuickBooks Online and others.

How can Cloud Accounting help me?

Instant Access.

Whether you’re at your desk or on the move, maintaining your business records has never been easier. All you need is a mobile device, like a tablet or a smartphone, and a half-decent internet connection and you never need to be tied down to your desk again.

Clearer overview of financial position.

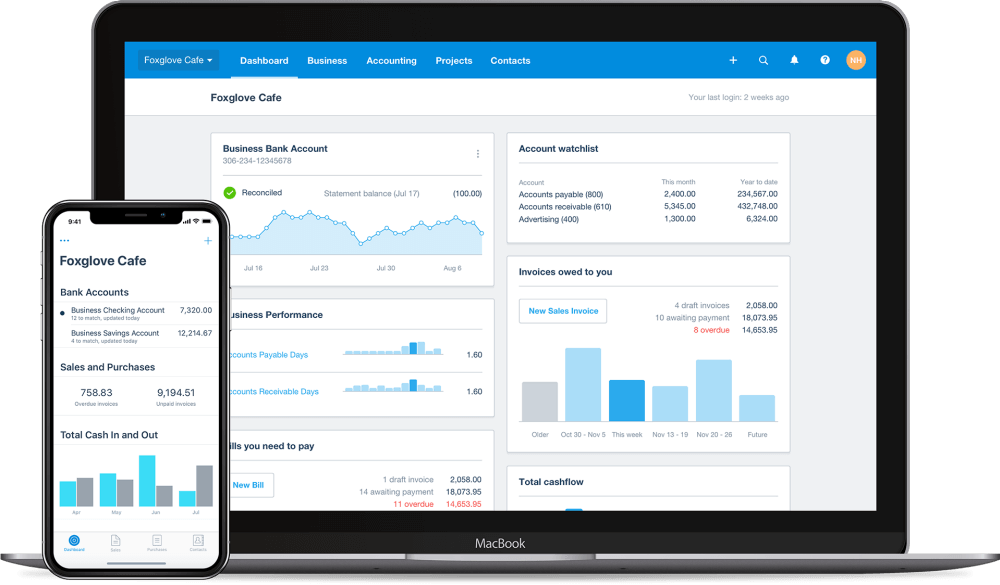

Gone are the days of waiting 12 months after the end of your accounting period for a set of accounts to tell you what you did over 12 months ago. Cloud accounting allows you to know exactly where your business is at any one time. Cloud accounting software provides all vital financial statistics in a clear dashboard style that means you can view crucial information in seconds.

Automatic bank feeds.

The software is designed so that it can sync with your bank, meaning that bank transactions are immediately fed into the right accounts and sorted by category.

Multi-user access

Allows you to collaborate with different members of your team. You can also give us access to either review or edit the information, or do all the processing on your behalf.

Cuts costs.

Cloud accounting software is very cost-efficient. The fact that it is on the Cloud means that you don’t have to upgrade your equipment frequently. There’s nothing to install or update, and you’ll never need to do a backup again.

Makes you money.

While CRM software can tell you how your business is doing from a sales front, Cloud Accounting software tells you what needs to be invoiced and when, and allows you to keep track of outstanding invoices. You never need to worry about cash flow management again.

Frees up time for you to focus on your business.

As information is available in a timelier manner, you can log into your software and see how your business is performing, helping you to make important business decisions with greater ease.

No more missing document requests.

As long as you are uploading your receipts and invoices regularly, you never have to provide us with your records! All bank transactions are automatically fed into the system and invoices are instantly available, meaning you’ll stop getting those reminders to provide a missing statement or invoice.

Making Tax Digital is here.

HMRC requires all VAT registered businesses to maintain digital records and file returns through MTD compliant software. This couldn’t be easier when using cloud-based software and ensures you are future proof for further MTD requirements coming soon.

Which software is for me?

There are many offerings in a crowded market, including Xero, QuickBooks Online, Kashflow, FreeAgent, Clearbooks and Sage Business Accounting. Key considerations:

Who will be the primary users?

If the majority of users are employees with little to no accounting knowledge, then whatever system implemented must be easy to use. A clear layout, user interface and clearly defined data entry fields are a must.

Reporting.

Reporting.

The number and quality of reports available differ greatly between the various products. As a business owner, there is little use in having a sophisticated system that doesn’t show you what you really need to know.

Dashboard.

The dashboard shows you key financial information in a snapshot. This is particularly important if you are poor on time and need information quickly. The various providers have different levels of customisable dashboards that can be tailored to show you what you need when you need it.

Integration.

The majority of the time-saving is driven by the ability of Cloud Accounting software to integrate with banks to automatically download your statements and third-party apps. Such apps include Receipt Bank, which automatically reads and processes receipts and invoices.

Ready to make your accounting easier?

At Sigma, we are passionate about helping small businesses overcome everyday hurdles and put business owners in a position where they can concentrate their efforts on making their business a success. Sigma has been at the forefront of the digital revolution and has built up years of experience in this field.

Please speak to one of our certified cloud advisors now.